The FCA have chosen to now regulate Buy Now Pay Later Schemes.

OpenMoney’s research recently revealed that more than a third have struggled to pay back items they have bought using a Buy Now Pay Later (BNPL) scheme, 1 in 10 had been left struggling to pay their rent for Buy Now Pay Later schemes and 62 per cent left with feelings of anxiety and depression and 81 per cent worried about long-term future debt it could cause.

As a result OpenMoney had been campaigning for months to help support people through their YOPO campaign (https://www.open-money.co.uk/yopo) and today’s decision is a real success.

Anthony Morrow, Co-Founder of OpenMoney has said:

““We have long argued that Buy Now Pay Later (BNPL) schemes, like Klarna and ClearPay, make it very easy to take on debt without fully thinking about how to pay it back or the implications if you don’t. Use of these schemes has exploded during the pandemic, playing on our fear of missing out through manipulative advertising and irresponsible encouragement by social media influencers to convince people borrow money to fund a lifestyle they can’t afford.”

“We are delighted that the FCA has decided to take action. Regulation will offer consumers the same protection they have with other types of credit, including affordability checks before taking on a new loan and support if they subsequently struggle with repayments.”

BNPL schemes will now come under FCA regulation

* Research found more than a third have struggled to pay back items they have bought using a Buy Now Pay Later (BNPL) scheme

* 35 per cent admitted they use Buy Now Pay Later schemes because they can’t afford the items they want

* A quarter have had to ask family or friends to pay back money, 1 in 10 are left struggling to pay their rent

* 62 per cent left with feelings of anxiety and depression and 81 per cent worried about long-term future debt it could cause

Buy Now Pay Later (BNPL) schemes have previously allowed people to make purchases without the money coming out of their account immediately. These schemes have been used by over half (51 per cent) of under 25s according to new research and more than third of them (38 per cent) have said they have struggled to pay the money back.

According to OpenMoney’s research, the problem with the BNPL schemes is that they were causing people to spend money that they don’t have with 37 per cent admitting they had splashed out on items they would not have been able to afford if it were not for the scheme. In reality, the research also showed that people use BNPL schemes as a loophole for spending, with over a third (35 per cent) suggesting they use BNPL schemes when they cannot afford the items they want to buy.

As a result a quarter (26 per cent) had to turn to family or friends for the money and 1 in 10 left struggling to pay their rent. A further 1 in 10 have even had to move back in with their parents as a result of the building bills caused by these schemes.

The dangers of debt were also concerning due to the negative affects on mental health with 62 per cent claiming it causes anxiety and feelings of depression. Many (81 per cent) said they were worried about how the online spending could lead to long-term in the future with one in three (35 per cent) saying their worries over debt has prevented them sleeping. 43 per cent also claim they feel ‘trapped’ with ‘no way out’.

The pandemic financially hit many people, and with more than a quarter (28 per cent) of respondents saying they were made redundant and 33 per cent advising they’d been furloughed since March, it is no surprise that many claimed they have been tackling boredom with spending but 33 per cent have admitted they have done so on purchases they cannot afford. In fact, more than half (51 per cent) have said that BNPL schemes meant they spent more in lockdown.

What is Buy Now Pay Later?

Buy Now Pay Later (BNPL) schemes are becoming a popular form of payment online. Rather than pay the upfront cost for an online purchase, you can choose to spread the cost over a few weeks/months or delay the full payment until a later date. With the help of social media, brands and influencers are encouraging increasing usage of providers like Klarna, Clearpay, Laybuy and Afterpay.

For more information and data on the campaign https://open-money.co.uk/yopo

[2,000 UK residents aged between 18 & 50 completed the survey between 22 October 2020 and 29 October 2020. Social media and online analysis of 70k posts by 36k unique authors took place between October 2019 and October 2020.]

About OpenMoney:

OpenMoney is a low cost online financial advice service for savers and investors. It combines technology and human advisers to make financial advice and investing accessible and affordable to everyone - whatever your age, wealth or experience.

A complete financial picture:

It has a useful app where you can connect all your accounts to see all your money in one place. OpenMoney will then start advising you on how to manage your money better.

Watch ! Silk's Breakfast Show presenter Darren Antrobus talking to Anthony Morrow, Co-Founder of OpenMoney.

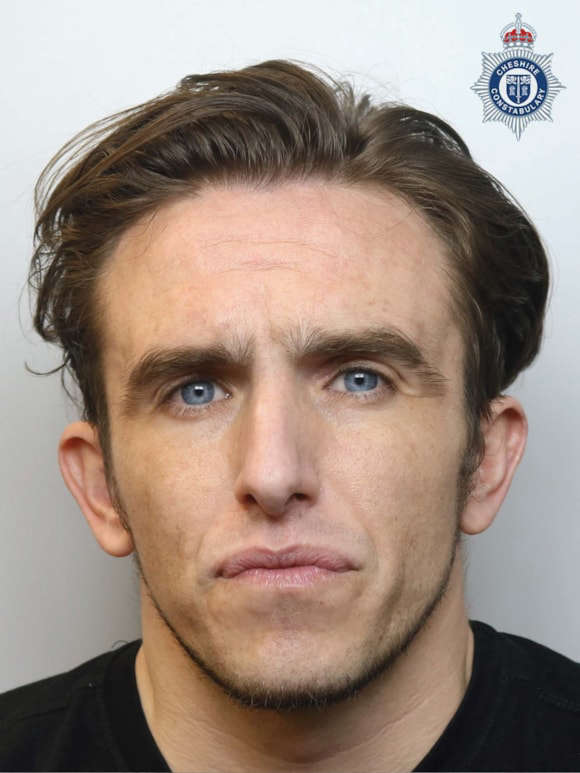

Drink driver jailed following fatal collision in Crewe

Drink driver jailed following fatal collision in Crewe

MP Praises WorkTaste Placement at King’s School

MP Praises WorkTaste Placement at King’s School

Three men sentenced for drug dealing in Macclesfield

Three men sentenced for drug dealing in Macclesfield

Tree planted to honour devoted foster carers during Foster Care Fortnight

Tree planted to honour devoted foster carers during Foster Care Fortnight

Appeal for information following serious sexual assault in Knutsford

Appeal for information following serious sexual assault in Knutsford

Rural Crime Team equipped with mobile defibrillators

Rural Crime Team equipped with mobile defibrillators

Enterprising Future For Macclesfield

Enterprising Future For Macclesfield

Is being a wholetime firefighter the job for you?

Is being a wholetime firefighter the job for you?

Community café and support centre has secured support from Knutsford Town Council

Community café and support centre has secured support from Knutsford Town Council

£1k boost to Knutsford In Bloom

£1k boost to Knutsford In Bloom

Council and football club strike deal to deliver major revamp of local sports facility

Council and football club strike deal to deliver major revamp of local sports facility

Cheshire Constabulary to support national operation to cut out county-wide knife crime

Cheshire Constabulary to support national operation to cut out county-wide knife crime

It's up to everyone to help keep public toilets open

It's up to everyone to help keep public toilets open

Local swim school takes lifesaving efforts onto dry land

Local swim school takes lifesaving efforts onto dry land

Deal to deliver major revamp of local sports facility

Deal to deliver major revamp of local sports facility

Work gets underway on Congleton War Memorial Hospital’s ‘Wellbeing Garden’

Work gets underway on Congleton War Memorial Hospital’s ‘Wellbeing Garden’

Old School Disco night in aid of Macclesfield Hospital’s breast screening unit

Old School Disco night in aid of Macclesfield Hospital’s breast screening unit

Rugby player Doddie Weir’s MND campaign celebrated at RHS Flower Show Tatton Park

Rugby player Doddie Weir’s MND campaign celebrated at RHS Flower Show Tatton Park

Mid Cheshire Hospitals Dermatology team takes aim at myths and promotes skin health

Mid Cheshire Hospitals Dermatology team takes aim at myths and promotes skin health

Comments

Add a comment