Parents of new-borns will still be able to claim Child Benefit despite the outbreak of coronavirus, HMRC announces today.

Even though General Register Offices remain closed for now, parents can still claim Child Benefit without having to register their child’s birth first to ensure that they do not miss out.

First time parents will need to fill in Child Benefit Claim form CH2 found online and send it to the Child Benefit Office. If they haven’t registered the birth because of COVID-19, they should add a note with their claim to let us know.

If they already claim Child Benefit, they can complete the form or add their new-born’s details over the telephone on 0300 200 3100. You will need your National Insurance number or Child Benefit number.

Child Benefit claims can be backdated by up to three months.

This announcement is timely as child benefit payments increase from 6 April to a weekly rate of £21.05 for the first child and £13.95 for each additional child. Child Benefit is paid into your bank account, usually every 4 weeks.

Only one person can claim Child Benefit for a child. For couples with one partner not working or paying National Insurance contributions, making the claim in their name will help protect their State Pension.

Financial Secretary to the Treasury, Jesse Norman, said:

“We need people to stay at home in order to protect the NHS and save lives. Today’s change means new parents won’t miss out financially and can keep their families safe.

“The Government will do whatever it takes to support people and the NHS during this outbreak, and HMRC are working around the clock to help families and businesses across the UK.”

Angela MacDonald, Director General for Customer Services, HMRC said:

“It’s really important that new parents remember to register for Child Benefit, even during these unprecedented times.

“The increase in Child Benefit is a boost for family budgets but there’s more to claiming than the payments. We’re encouraging people to claim so they don’t miss out on National Insurance credits that help protect their State Pension. It also helps children to get their National Insurance number automatically at 16.”

HMRC is reminding High Income Child Benefit Charge customers of the importance of claiming child benefit, even if they choose to opt out of receiving monetary benefits.

The tax charge applies to anyone with an income over £50,000, who claims Child Benefit or whose partner claims it. Even if you do have to pay the tax charge, you could still be better off by claiming Child Benefit - the tax is 1% of Child Benefit for each £100 of income over £50,000.

You can use the Child Benefit tax calculator to work out how much you may have to pay, or you can opt out of receiving Child Benefit payments altogether when you complete the form, so you won't have to pay the charge but will still protect your State Pension.

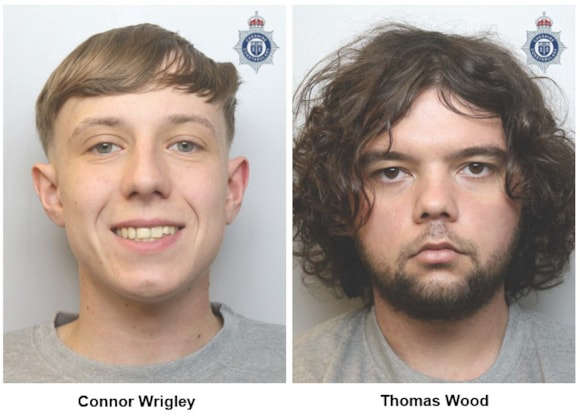

Congleton man jailed for engaging in sexual communications with a child

Congleton man jailed for engaging in sexual communications with a child

Three men sentenced following Disley burglary

Three men sentenced following Disley burglary

Two men sentenced following violent altercation in Winsford

Two men sentenced following violent altercation in Winsford

Local Mental Health Nurse awarded prestigious Queen’s Nurse title

Local Mental Health Nurse awarded prestigious Queen’s Nurse title

Musica Nova March Concert

Musica Nova March Concert

Macclesfield smashes Pancake Race for local NHS charity

Macclesfield smashes Pancake Race for local NHS charity

Cannabis farmer who hid for eight hours during registry office raid jailed

Cannabis farmer who hid for eight hours during registry office raid jailed

Man charged with burglary and driving offences

Man charged with burglary and driving offences

Cheshire Police Commissioner revealed to be billing luxury car costs to taxpayer.

Cheshire Police Commissioner revealed to be billing luxury car costs to taxpayer.

County-wide collaborative immigration and safeguarding operation yields positive results

County-wide collaborative immigration and safeguarding operation yields positive results

Beech Hall School Marks Children’s Mental Health Week with Animal Therapy Experience

Beech Hall School Marks Children’s Mental Health Week with Animal Therapy Experience

Appeal for witnesses following attempt burglary in Alsager

Appeal for witnesses following attempt burglary in Alsager

Man jailed for stealing from shops in Congleton

Man jailed for stealing from shops in Congleton

Match Report - Macclesfield Town 0 - 1 Brentford

Match Report - Macclesfield Town 0 - 1 Brentford

Update on Flag Lane Baths

Update on Flag Lane Baths

Council supports stronger measures to curb smartphone use in Cheshire schools

Council supports stronger measures to curb smartphone use in Cheshire schools

Man arrested following M6 police pursuit

Man arrested following M6 police pursuit

Call for sites launched to help shape new Cheshire East Local Plan

Call for sites launched to help shape new Cheshire East Local Plan