HM Revenue and Customs (HMRC) is warning Post Office card account holders, who receive HMRC-related payments, that time is running out – with just two weeks left to switch their accounts.

HM Revenue and Customs (HMRC) is warning Post Office card account holders, who receive HMRC-related payments, that time is running out – with just two weeks left to switch their accounts.

About 6,800 Post Office card account customers, who receive tax credits, Child Benefit or Guardian’s Allowance payments, need to transfer their account by 5 April 2022 to continue receiving their money without interruption.

HMRC is stopping making payments to Post Office card accounts from 6 April. Customers, who have not done so already, must notify HMRC of an alternative account to have their payments paid into. It will not be possible to pay tax credits or Child Benefit until a valid account is provided.

These could be vital funds for families and individuals, due to the rise in the cost of living, and HMRC wants to make sure no-one loses out.

Myrtle Lloyd, HMRC’s Director General for Customer Services said: “Time is running out and we want to make sure that no customer misses out on the benefit payments they are entitled to. If you still need to switch your Post Office card account, contact HMRC to update your bank account details.”

HMRC has been writing to affected customers since October 2019 to notify them that their Post Office card accounts will be closing and urging them to take action. More than 143,000 customers have already switched their accounts and provided HMRC with updated details.

Customers can choose to receive their benefit payments to a bank, building society or credit union account. If they already have an alternative account, they can contact HMRC now to update their details.

Child Benefit and Guardian’s Allowance customers can use their Personal Tax Account to provide revised account details, change their bank account details via GOV.UK or by contacting the Child Benefit helpline on 0300 200 3100. Tax credits customers can change their bank account details by contacting the tax credits helpline on 0345 300 3900. If customers cannot open a bank account, they should contact HMRC.

If a customer misses the 5 April deadline, their payments will be paused until the customer notifies HMRC of their new account details.

The Money Helper website, provided by the Money Advice and Pensions Service, offers information and advice about how to choose the right current account and how to open an account.

Congleton man jailed for engaging in sexual communications with a child

Congleton man jailed for engaging in sexual communications with a child

Three men sentenced following Disley burglary

Three men sentenced following Disley burglary

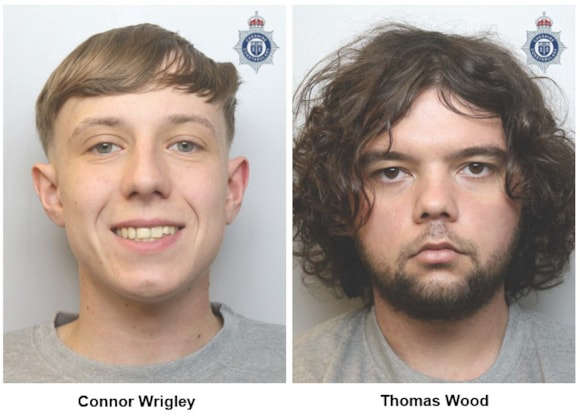

Two men sentenced following violent altercation in Winsford

Two men sentenced following violent altercation in Winsford

Local Mental Health Nurse awarded prestigious Queen’s Nurse title

Local Mental Health Nurse awarded prestigious Queen’s Nurse title

Musica Nova March Concert

Musica Nova March Concert

Macclesfield smashes Pancake Race for local NHS charity

Macclesfield smashes Pancake Race for local NHS charity

Cannabis farmer who hid for eight hours during registry office raid jailed

Cannabis farmer who hid for eight hours during registry office raid jailed

Man charged with burglary and driving offences

Man charged with burglary and driving offences

Cheshire Police Commissioner revealed to be billing luxury car costs to taxpayer.

Cheshire Police Commissioner revealed to be billing luxury car costs to taxpayer.

County-wide collaborative immigration and safeguarding operation yields positive results

County-wide collaborative immigration and safeguarding operation yields positive results

Beech Hall School Marks Children’s Mental Health Week with Animal Therapy Experience

Beech Hall School Marks Children’s Mental Health Week with Animal Therapy Experience

Appeal for witnesses following attempt burglary in Alsager

Appeal for witnesses following attempt burglary in Alsager

Man jailed for stealing from shops in Congleton

Man jailed for stealing from shops in Congleton

Match Report - Macclesfield Town 0 - 1 Brentford

Match Report - Macclesfield Town 0 - 1 Brentford

Update on Flag Lane Baths

Update on Flag Lane Baths

Council supports stronger measures to curb smartphone use in Cheshire schools

Council supports stronger measures to curb smartphone use in Cheshire schools

Man arrested following M6 police pursuit

Man arrested following M6 police pursuit

Call for sites launched to help shape new Cheshire East Local Plan

Call for sites launched to help shape new Cheshire East Local Plan

Comments

Add a comment