This week, HM Revenue and Customs will start contacting around three and a half million customers who may be eligible for the government’s Self-Employment Income Support Scheme to explain the application process and help them get ready to make a claim.

The claims service opens on Wednesday 13 May and is being delivered ahead of schedule, with payments reaching bank accounts by 25 May, or six working days after the claim is made.

The scheme will benefit self-employed individuals or those in a partnership whose business has been adversely affected by coronavirus, covering most people who get at least half of their income from self-employment. SEISS is a temporary scheme that will enable those eligible to claim a taxable grant worth 80% of their average trading profits up to a maximum of £7,500 (equivalent to three months’ profits) in a single instalment.

HMRC is using information that customers have provided in their 2018-19 tax return – and returns for 2016-17 and 2017-18 where needed – to determine their eligibility and is contacting customers who may be eligible via email, SMS or letter. We’re also opening an online checker from Monday 4 May which will let customers check their eligibility for themselves, as well as giving them a date on which they can apply.

Customers are eligible if their business has been adversely affected by coronavirus, they traded in 2019-20, intend to continue trading and they:

· Earn at least half of their income through self-employment;

· Have trading profits of no more than £50,000 per year; and

· Traded in the tax year 2018 to 2019 and submitted their Self Assessment tax return on or before 23 April 2020 for that year.

Where individuals are ineligible for the scheme, HMRC will direct them to guidance setting out the conditions to help them understand why they are ineligible, and advice about other support that might be available to them such as: income tax deferrals, rental support, Universal Credit, access to mortgage holidays and the various business support schemes the government has introduced to protect businesses during this time.

We expect our phone lines to be very busy over the next few weeks as people enter this new scheme, so are encouraging customers to only call us if they can’t find what they need on GOV.UK, from their tax agent or via our webchat service – this will leave the lines open for those who need our help most.

Ed Casson | Regional External Communications Officer - North West | HM Revenue & Customs | 03000 524697 | 07815 444469

Follow HMRC on Twitter at: @hmrcgovuk

Congleton man jailed for engaging in sexual communications with a child

Congleton man jailed for engaging in sexual communications with a child

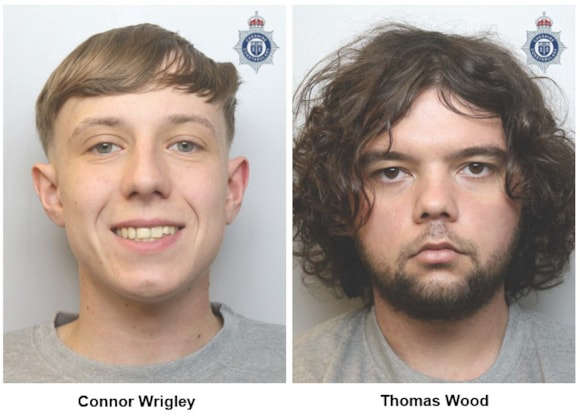

Three men sentenced following Disley burglary

Three men sentenced following Disley burglary

Two men sentenced following violent altercation in Winsford

Two men sentenced following violent altercation in Winsford

Local Mental Health Nurse awarded prestigious Queen’s Nurse title

Local Mental Health Nurse awarded prestigious Queen’s Nurse title

Musica Nova March Concert

Musica Nova March Concert

Macclesfield smashes Pancake Race for local NHS charity

Macclesfield smashes Pancake Race for local NHS charity

Cannabis farmer who hid for eight hours during registry office raid jailed

Cannabis farmer who hid for eight hours during registry office raid jailed

Man charged with burglary and driving offences

Man charged with burglary and driving offences

Cheshire Police Commissioner revealed to be billing luxury car costs to taxpayer.

Cheshire Police Commissioner revealed to be billing luxury car costs to taxpayer.

County-wide collaborative immigration and safeguarding operation yields positive results

County-wide collaborative immigration and safeguarding operation yields positive results

Beech Hall School Marks Children’s Mental Health Week with Animal Therapy Experience

Beech Hall School Marks Children’s Mental Health Week with Animal Therapy Experience

Appeal for witnesses following attempt burglary in Alsager

Appeal for witnesses following attempt burglary in Alsager

Man jailed for stealing from shops in Congleton

Man jailed for stealing from shops in Congleton

Match Report - Macclesfield Town 0 - 1 Brentford

Match Report - Macclesfield Town 0 - 1 Brentford

Update on Flag Lane Baths

Update on Flag Lane Baths

Council supports stronger measures to curb smartphone use in Cheshire schools

Council supports stronger measures to curb smartphone use in Cheshire schools

Man arrested following M6 police pursuit

Man arrested following M6 police pursuit

Call for sites launched to help shape new Cheshire East Local Plan

Call for sites launched to help shape new Cheshire East Local Plan