HM Revenue and Customs (HMRC) is warning Self Assessment customers to be on their guard following the Self Assessment deadline after more than 570,000 scams were reported to HMRC in the last year.

At this time of year, Self Assessment customers are at increased risk of falling victim to scams, even if they don’t mention Self Assessment. They can be taken in by scam texts, emails or calls either offering a ‘refund’ or demanding unpaid tax, thinking that they are genuine HMRC communications referring to their Self Assessment return. In the 12 months to January 2022, nearly 220,000 scams reported to HMRC offered bogus tax rebates.

Criminals target unsuspecting Self Assessment customers to try and steal money or personal information. They use phone calls, texts and emails to try and dupe citizens, and often mimic government messages to make them appear authentic. In January 2022, phone scams rose to 3,995 compared to 425 reported in April 2020.

Myrtle Lloyd, HMRC’s Director General for Customer Services, said: “If someone contacts you saying they’re from HMRC, wanting you to transfer money or give personal information, be on your guard.

“Never let yourself be rushed, and if you’re in any doubt then check our ‘HMRC scams’ advice on GOV.UK.”

HMRC gave customers an extra month to submit a completed tax return and if customers filed by 28 February 2022, they would avoid a late filing penalty. More than 11.3 million customers filed their Self Assessment tax return by 28 February, with more than 1 million of those taking advantage of the extra time by filing in February.

Customers have until 1 April to pay their outstanding tax bill or set up a Time to Pay arrangement to avoid receiving a late payment penalty. Interest has been applied to all outstanding balances since 1 February.

Customers can now make Self Assessment payments quickly and securely through the HMRC app. Customers choosing to make secure Self Assessment payments through the HMRC app can either connect to their bank to make their payments or pay by Direct Debit, personal debit card or corporate/commercial credit/debit card.

A full list of the payment methods customers can use to pay their Self Assessment tax bill is available on GOV.UK.

Customers can report suspicious phone calls using a form on GOV.UK. Customers can also forward suspicious emails claiming to be from HMRC to phishing@hmrc.gov.uk and texts to 60599.

HMRC has a dedicated team working on cyber and phone crimes. They use innovative technologies to prevent misleading and malicious communications from ever reaching the customer. Since 2017, these technical controls have prevented 500 million emails from reaching HMRC’s customers. More recently, new controls have prevented 90% of the most convincing SMS messages from reaching the public and controls have been applied to prevent spoofing of most HMRC helpline numbers.

HMRC is also reminding Self Assessment customers to double check websites and online forms before using them to complete their 2020/21 tax return. People can be taken in by misleading websites designed to make them pay for help in submitting tax returns or charging to connect them to HMRC phone lines. Customers who are in any doubt about whether a website is genuine should visit GOV.UK for more information about Self Assessment and use the free signposted tax return forms.

- The Self Assessment deadline for 2020/21 tax returns was 31 January 2022.

- The free HMRC app is available on either the App Store for iOS or the Google Play Store for Android. Customers will need their Government Gateway user ID and password to sign into their account for the first time.

HMRC’s advice to the public:

Stop:

· Take a moment to think before parting with your money or information.

· If a phone call, text or email is unexpected, don’t give out private information or reply, and don’t download attachments or click on links before checking on GOV.UK that the contact is genuine.

· Do not trust caller ID on phones. Numbers can be spoofed.

Challenge:

· It’s ok to reject, refuse or ignore any requests - only criminals will try to rush or panic you.

· Search ‘scams’ on GOV.UK for information on how to recognise genuine HMRC contact and how to avoid and report scams.

Protect:

· Forward suspicious texts claiming to be from HMRC to 60599 and emails to phishing@hmrc.gov.uk. Report tax scam phone calls on GOV.UK.

· Contact your bank immediately if you think you’ve fallen victim to a scam, and report it to Action Fraud (in Scotland, contact the police on 101).

In the last 12 months (to January 2022) HMRC has:

· responded to 572,423 referrals of suspicious contact from the public. More than 219,740 of these offered bogus tax rebates

· worked with the telecoms industry and Ofcom to remove more than 920 phone numbers being used to commit HMRC-related phone scams

· responded to 267,671 reports of phone scams in total. In April 2020 HMRC received reports of only 425 phone scams. In January 2022 this had risen to 3,995

· reported more than 6,160 malicious web pages for takedown

· detected 463 Covid-related financial scams since March 2020, most by text message

. asked Internet Service Providers to take down 443 Covid-related scam web pages

Northwich man jailed for drug dealing and assault

Northwich man jailed for drug dealing and assault

Mid Cheshire Hospitals NHS Foundation Trust told to make improvements in maternity services

Mid Cheshire Hospitals NHS Foundation Trust told to make improvements in maternity services

93% of parents receive offer of first preference of primary school

93% of parents receive offer of first preference of primary school

Police appeal for help in tracing wanted Hanley man

Police appeal for help in tracing wanted Hanley man

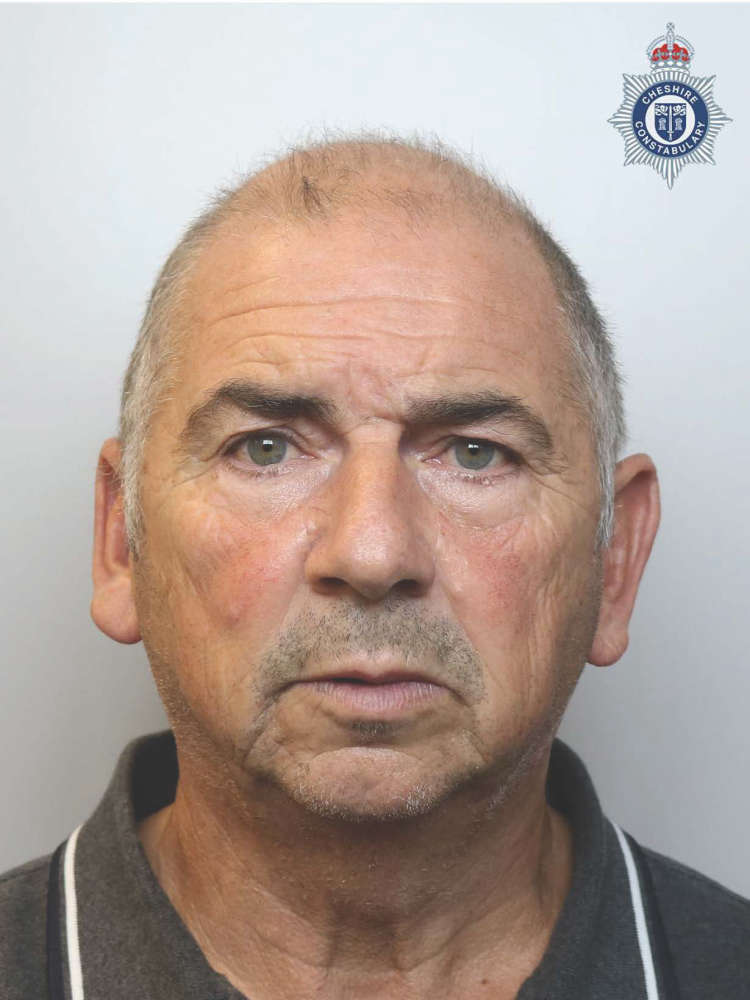

Physiotherapist who sexually assaulted woman in Willaston is jailed

Physiotherapist who sexually assaulted woman in Willaston is jailed

Crewe man jailed for sexually abusing young boys online

Crewe man jailed for sexually abusing young boys online

Fun for all ages at Reaseheath College’s annual Family Festival

Fun for all ages at Reaseheath College’s annual Family Festival

Cheshire Police among top performing forces for tackling drink and drug driving

Cheshire Police among top performing forces for tackling drink and drug driving

Appeal for information following serious collision near Congleton

Appeal for information following serious collision near Congleton

Pink Floyd: The Dark Side of the Moon returns to Jodrell Bank

Pink Floyd: The Dark Side of the Moon returns to Jodrell Bank

Drug dealer sentenced following successful stop and search in Northwich

Drug dealer sentenced following successful stop and search in Northwich

Inspired Villages complete a 7,500-Mile Charity Cycling Challenge in aid of PROSTaid UK

Inspired Villages complete a 7,500-Mile Charity Cycling Challenge in aid of PROSTaid UK

Man found guilty following historic sexual abuse of a child over 20 years ago

Man found guilty following historic sexual abuse of a child over 20 years ago

Local golf club donates £20,000 to East Cheshire NHS Charity

Local golf club donates £20,000 to East Cheshire NHS Charity

Free Health and Wellbeing Fair at Wilmslow Leisure Centre

Free Health and Wellbeing Fair at Wilmslow Leisure Centre

Check you have the right photo ID to vote in person on 2nd May

Check you have the right photo ID to vote in person on 2nd May

Work starts on a new Cheshire East Local Plan

Work starts on a new Cheshire East Local Plan

Council asks – Can you help us tackle climate change?

Council asks – Can you help us tackle climate change?

First ‘Pocket Park’ revamped in Crewe

First ‘Pocket Park’ revamped in Crewe

Knutsford man and his cousins take on the Manchester Marathon to fundraise for The Christie Charity

Knutsford man and his cousins take on the Manchester Marathon to fundraise for The Christie Charity

Comments

Add a comment