Small businesses and employers across the UK who have paid statutory sick pay to staff taking coronavirus-related leave will be able to claim back the money from today.

In a further boost to employers affected by the outbreak, The Coronavirus Statutory Sick Pay Rebate Scheme – which was announced by Chancellor Rishi Sunak at the Budget -opened for applications this morning.

The scheme allows small and medium sized employers, with fewer than 250 members of staff, to apply to recover the costs of paying coronavirus-related Statutory Sick Pay for two weeks - worth nearly £200 per employee.

Launching on gov.uk today, the new online service is being run by HMRC, and after making an application employers will receive the money within six working days.

To get the rebate, employers will need to go online and input simple information on the employees being claimed for.

The service can be accessed here.

Notes

- The current rate of SSP is £95.85 per week. Employers can choose to go further and pay more than the statutory minimum. This is known as occupational or contractual sick pay.

- Where an employer pays more than the current rate of SSP in sick pay, they will only be able to reclaim the SSP rate.

The scheme covers all types of employment contracts, including:

- full-time employees

- part-time employees

- employees on agency contracts

- employees on flexible or zero-hour contracts

- other SSP eligibility criteria apply

- tax agents can make claims on behalf of their employers

-

Connected companies and charities can also use the scheme if their total combined number of PAYE employees are fewer than 250 on or before 28 February 2020. Employees do not have to provide a doctor’s fit note in order for their employer to make a claim under the scheme make a claim.

-

The repayment will cover up to two weeks of SSP from either 13 March 2020, if an employee had coronavirus, symptoms or is self isolating because someone they live with has symptoms, or from 16 April 2020 if an employee was shielding because of coronavirus.

- Employers can furlough their employees who have been advised to shield in line with public health guidance and are unable to work from home, under the Coronavirus Job Retention Scheme. Once furloughed, the employee should no longer receive SSP and would be classified as a furloughed employee. Where an employee has been notified to shield and has not been furloughed, the rebate will compensate up to 2 weeks of SSP from 16 April.

Call for sites launched to help shape new Cheshire East Local Plan

Call for sites launched to help shape new Cheshire East Local Plan

Man jailed for selling cannabis after previously being spared prison

Man jailed for selling cannabis after previously being spared prison

Officers appeal for information to help tackle anti-social e-bike riding in Winsford

Officers appeal for information to help tackle anti-social e-bike riding in Winsford

Predator jailed for 26 years in Northwich

Predator jailed for 26 years in Northwich

Applications for council’s warmer homes scheme are open

Applications for council’s warmer homes scheme are open

Man charged with making nuisance calls to police

Man charged with making nuisance calls to police

Man jailed for seven years for drugs offences in Crewe

Man jailed for seven years for drugs offences in Crewe

MACCLESFIELD’S SILK MUSEUM UNVEILS VIBRANT PROGRAMME FOR WOMEN’S HISTORY MONTH

MACCLESFIELD’S SILK MUSEUM UNVEILS VIBRANT PROGRAMME FOR WOMEN’S HISTORY MONTH

Vital investment for fire and rescue service agreed by councillors

Vital investment for fire and rescue service agreed by councillors

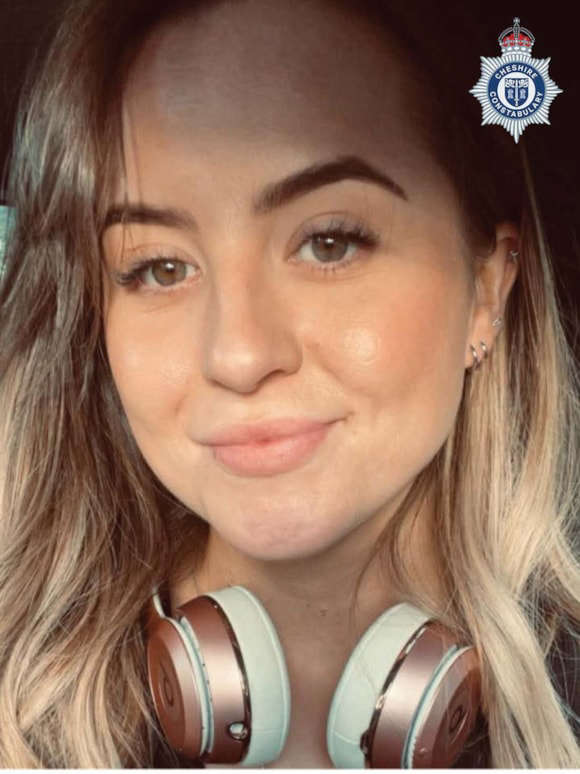

Tributes issued to off-duty officer following fatal collision in Arclid

Tributes issued to off-duty officer following fatal collision in Arclid

Criminal Behaviour Order bans prolific shoplifter from every Co-Op in Macclesfield and nine other retailers

Criminal Behaviour Order bans prolific shoplifter from every Co-Op in Macclesfield and nine other retailers

Dame Sarah Storey champions early breast cancer detection at Macclesfield Hospital

Dame Sarah Storey champions early breast cancer detection at Macclesfield Hospital

Appeal for information following fatal collision in Arclid

Appeal for information following fatal collision in Arclid

£19k worth of illicit tobacco and cigarettes seized from retailers as part of force-wide day of action

£19k worth of illicit tobacco and cigarettes seized from retailers as part of force-wide day of action

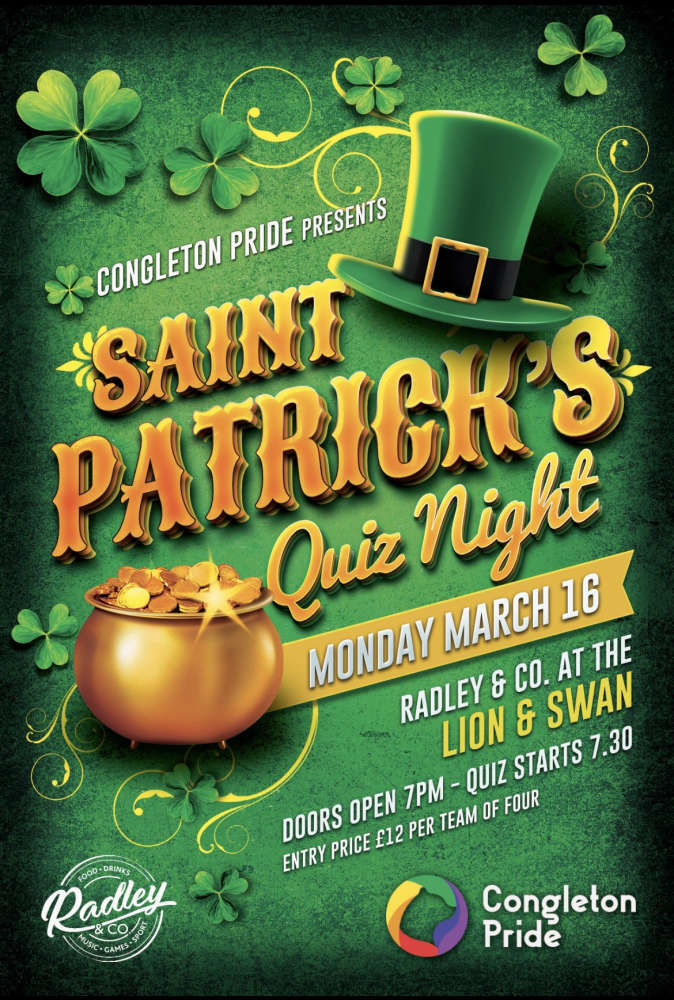

Congleton Pride’s St Patrick’s Day Quiz Night

Congleton Pride’s St Patrick’s Day Quiz Night

Application window now open for sponsors to apply for new primary school in Cheshire East

Application window now open for sponsors to apply for new primary school in Cheshire East